Reading an Irish payslip can seem complicated at first, but with some understanding of the various components, it becomes easier.

The first part of the Irish payslip is a section that lists the employee’s details, including name, PPS number, tax status details and how you were paid, e.g., via bank transfer (or other means like a cheque).

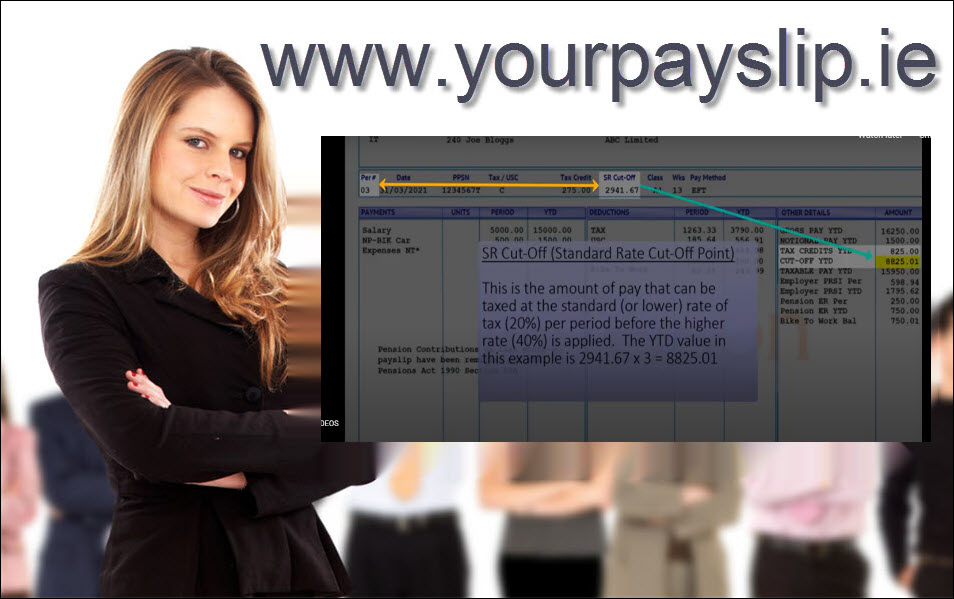

The second part of the payslip is usually split in three to show your earnings, deductions and overall balance & YTD (Year-To-Date) information.

Here’s an explanation of all the sections:

- Personal Information: At the top of your payslip, you’ll typically find your personal information, including your name, employee number, and sometimes your tax details like your PPS number (Personal Public Service Number) or and your tax status, e.g. C = Cumulative (or Normal), W = Week 1 /Month 1 Basis, E= Emergency.

- Pay Period: Your payslip will indicate the period for which you are being paid. It could be a week, a month, or whatever pay period is paid by your employer.

- Earnings: This section will outline your gross pay, which is your total pay before any deductions. It may include regular wages or salary, overtime, bonuses, or other types of earnings, depending on your employment arrangement. It may also hold BIK (Benefit-In-Kind) elements also known as Notional Pay if applicable in your company. Some payslips show full YTD info for each element.

- Deductions: This section will show all the deductions made from your gross pay, such as income tax (PAYE), social insurance (PRSI), and Universal Social Charge (USC). These deductions are required by law and may vary depending on your income and other factors. LPT (Local Property Tax) is also shown here if you have chosen to have this deducted through payroll.

- Net Pay: This is the amount you’ll receive after all deductions have been made. It’s commonly referred to as your “take-home pay” and is the actual amount you’ll receive in your bank account or in cheque/cash format.

- Other Deductions: Your payslip may also include other deductions, such as pension contributions, health insurance premiums, or union dues, if applicable.

- Year-to-Date (YTD) and Balances: Many payslips will include year-to-date (YTD) information, which shows your total earnings, deductions, and net pay for the current calendar year up to the pay period specified on the payslip. This helps you track your earnings and deductions over the course of the year. Balance values may also exist on some payslips for Employer Contributions (ER PRSI or Pension/PRSAs).

- Reducing Balances: If your employer makes deductions for other schemes on your behalf, those may be listed on your payslip as well, depending on what software or payroll provider you use. e.g., Bike to Work and Travel Passes – these will be reducing, i.e., they will show how much is left to be deducted, which can be useful information for you to see.

- Additional Information: Your payslip may also include other important information, such as your leave balance, sick pay, or other company-specific details, depending on your software or payroll provider.

- Messages: A custom message to your employees can also be added to the payslip, depending on your software or payroll provider, so you can advertise a position or simply send a seasonal message.

It’s essential to carefully review your payslip each time you receive it to ensure that it accurately reflects your earnings, deductions, and other details. If you have any questions or concerns, it’s best to reach out to your employer or human resources representative for clarification.

Please visit www.yourpayslip.ie for a very useful video on how to interpret your payslip.

For tips, tricks and payroll updates, SUBSCRIBE OR follow us on Twitter, LinkedIn, Facebook or Instagram.