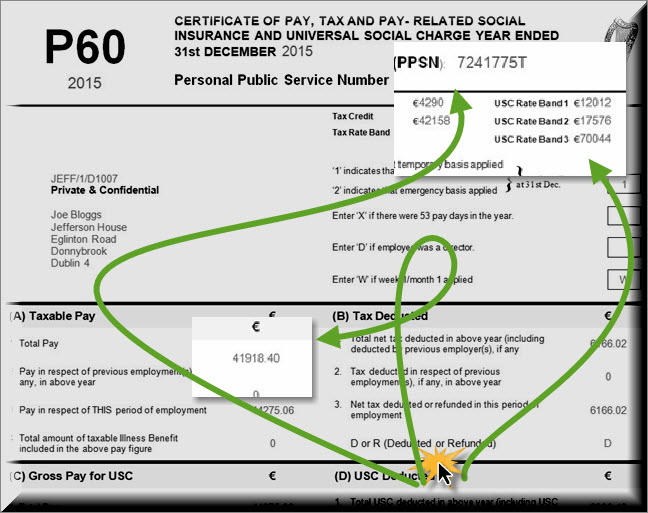

P60 EXPLAINED click on the image to help you interpret and understand your P60

Click the button below to learn how to read and interpret your P60

Instructions:

- click the P60 to get an instant explanation of sections

- some explanations have further details

- Layouts for P60s can vary (as different software has slightly different layouts)

- content of P60s are essentially the same

When do you receive your P60?

- Only when your employer’s P35 is complete can your P60 be issued

- It is normally issued in January (or by the latest February 23rd which is the P35 deadline)

- It is your earnings and tax record for the previous tax year

What do I need my P60 for?

- For seeking a tax refund / applying for a P21 balancing statement

- To help complete a tax return

- To apply for a loan or mortgage

- For queries on pay and tax for previous tax years

What is this guide for?

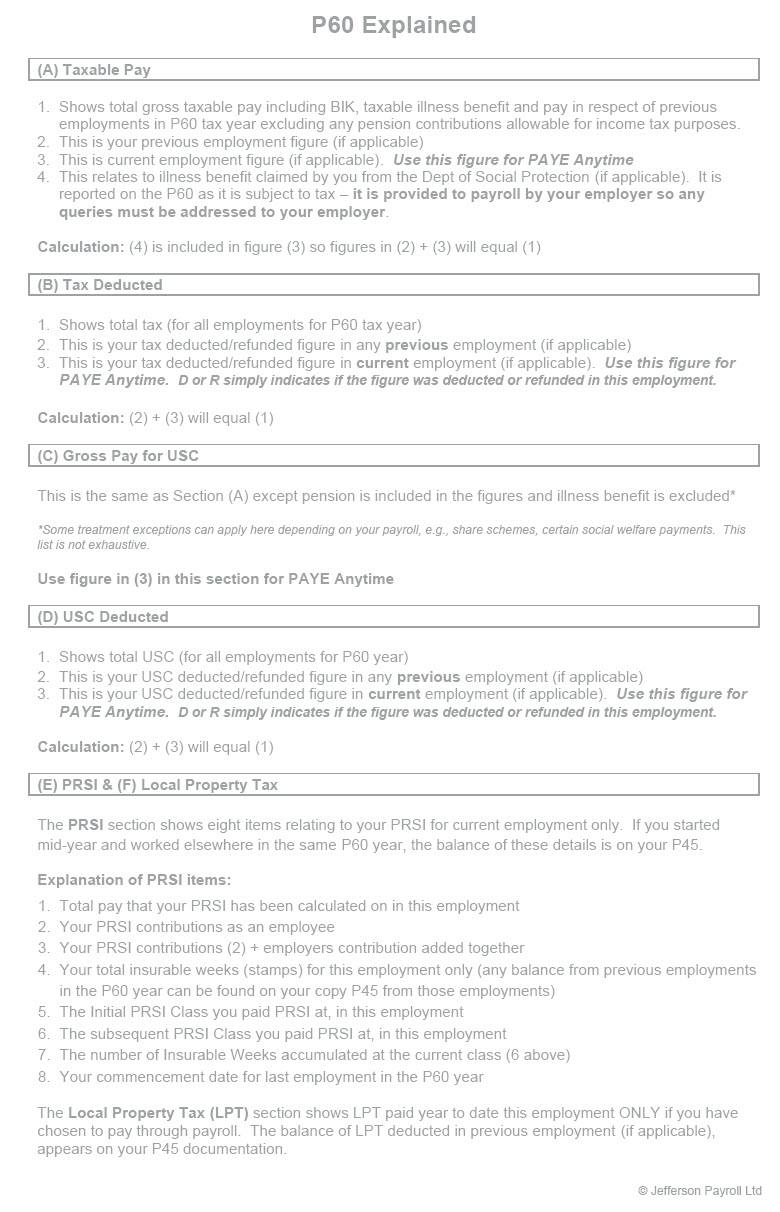

- This guide to help you understand your P60

- A P60 can change from year to year with elements often added as legislation changes in Ireland.

- This guide highlights each section on the P60 to hopefully help you learn how to read it and have a better understanding of an Irish P60 in general.

Other Services:

Jefferson Payroll offers Payslip & P60 presentations (so employees can learn specifically how their payslip calculations work specific to their payroll) and are available from mid-late February so let us know if your company is interested. For more details contact us.

OLDER P60 VERSIONS

2014 (issued in 2015) – P60 Explained – see below or view on Pinterest

2013 (issued in 2014) – P60 Explained – see below or view on Pinterest

2012 and prior years – P60 Explained – see below or view on Pinterest

↓ Ever wondered how payroll outsourcing works? ↓

For regular tips, tricks and payroll updates, enter your email on our site, OR follow us on Twitter, Facebook, Instagram, or LinkedIn All the best, The Team at Jefferson

Need p 60 from year jan 16 to dec 16

Hi Siobhan,

You should have received your P60 before the February deadline. If you need another copy, Jefferson provides a full set of “easy to print or email” employer copies so you could ask the relevant contact in your company for this.

Where is the “net relevant earnings” shown on the p60 ?

Rgds

There is no “net earnings” on a P60 as Revenue are not concerned about non-taxable payments, or gross deductions e.g., out-of-pocket expenses, bike to work deductions, etc.

They require a statement on your total taxable pay, total pay for USC, and pay subject to PRSI and what has been deducted in respect of same.

Can someone help me calculating the ‘net relevant earnings’ from P60 ? Is it the figure shown in section A or in section D (figure in section D much higher than section A) – for normal employee

thanks

Hi Cyril,

You cannot calculate net earnings from a P60. It is gross taxable earnings, your net pay is what you received on your payslips. If you have questions over what you were taxed on you can request a P21 balancing statement – simply search for it on Revenue.ie