What is Emergency Tax?

The Emergency Tax rules must be used by an Employer when:

The employer has not received, in respect of the employee, either a Tax Credit Certificate (P2C download via ROS) for the current year or a Form P45 for the current year or previous year OR The employee has given the employer a completed Form P45 indicating that the emergency basis applies, OR the employee has given the employer a completed P45 without a PPS number and not indicating that the emergency basis applies.

Tax is calculated on the gross pay (after deduction of Pension contributions and permanent health contributions where relevant). Different rules apply depending on whether or not the employee provides an employer with his/her PPS Number.

No PPS Number provided:

Where a new employee does not supply his employer with his PPS number, the employer is obliged to calculate the tax due on the employee’s earnings at the higher rate with no tax credit. Where the employee subsequently provides their PPS number the normal emergency basis will apply to the earnings in that and subsequent weeks.

- Tax Rates

- Standard Rate of Tax is 20%

- Higher Rate of Tax is 40%

Validation of PPS Number:

Where a new employee provides an employer with a PPS number the employer is obliged to take reasonable steps to ensure that the PPS number provided does in fact refer to that employee. The employer will be regarded as having taken reasonable measures where he or she checks the PPS number provided against any of the following documents:

– A tax credit certificate from a previous employment

– A Form P45

– A Social Welfare Services Card or PPSN Registration Letter issued by the Department of Social Protection

– A Notice of Assessment to Income Tax or Capital Gains Tax

– A Form P21 Balancing Statement

– A Form P60

– Any other item of correspondence from Revenue which specifically quotes the PPS Number

– A payslip from a previous employer which shows the PPS Number

Normal Emergency Rules:

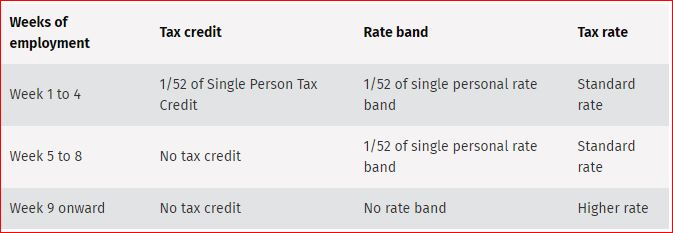

Under the normal Emergency Basis where a valid PPS number has been provided, a tax credit and Cut-Off Point (COP) is given for the first number of weeks and it is based on the single personal tax credit and COP for the tax year in force regardless of the employee’s marital status.

The normal emergency rules where a valid PPS number has been provided. The tax deductions are increased progressively after 4 weeks as follows:

Emergency Tax Rules

How long will I be on Emergency Tax?

As soon as you receive your P45, provide it to your EMPLOYER and they wills end it on to us for processing. Once is is processed and sent to Revenue via ROS, your details will be updated in the next P2C file download from Revenue, something we carry out once per pay period.

Your P2C details are then uploaded immediately to payroll so you are no longer on Emergency status. You should also receive a paper copy of your P2C to your home address as confirmation that you have been processed.

Please be patient while on Emergency Tax status as Jefferson Payroll cannot change your status until we receive an official certificate.

If any tax is owed to you, it will be refunded automatically in the pay period following your status change.

If you have no PPS number you will also be on Emergency Tax and may move to a Week 1/Month 1 (W status) once you receive a PPS number

For regular tips, tricks and payroll updates, enter your email on our site, OR follow us on Twitter, Facebook, Google+, or LinkedIn

All the best,

The Team at Jefferson