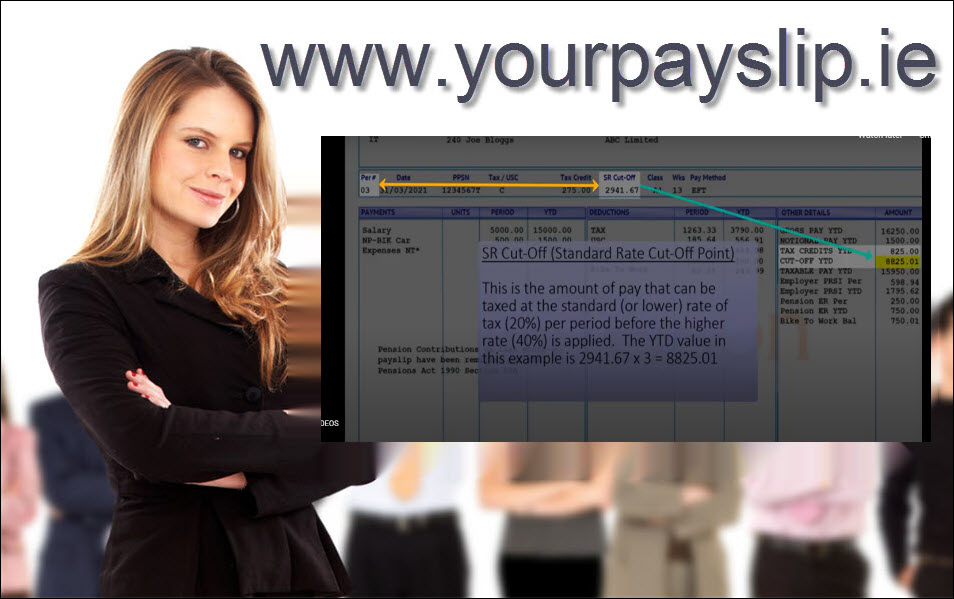

Please note this video contains a SAMPLE payslip for Ireland – as a sample all the elements shown in this video may NOT apply in your payroll situation.

Your payslip is an important piece of Irish legal documentation and it provides you with information about: