UPDATED Nov 2021 – slight changes in myAccount pages provided below

Here is your step-by-step guide to viewing (or saving/printing) your Employment Detail Summary (P60 equivalent for 2019 onward). It replaces your P60 (as a result of PAYE modernisation) but you will need to login in to Revenue’s myAccount to view or generate it.

Here’s how you do it in 5 simple steps:

STEP 1: Login to myAccount

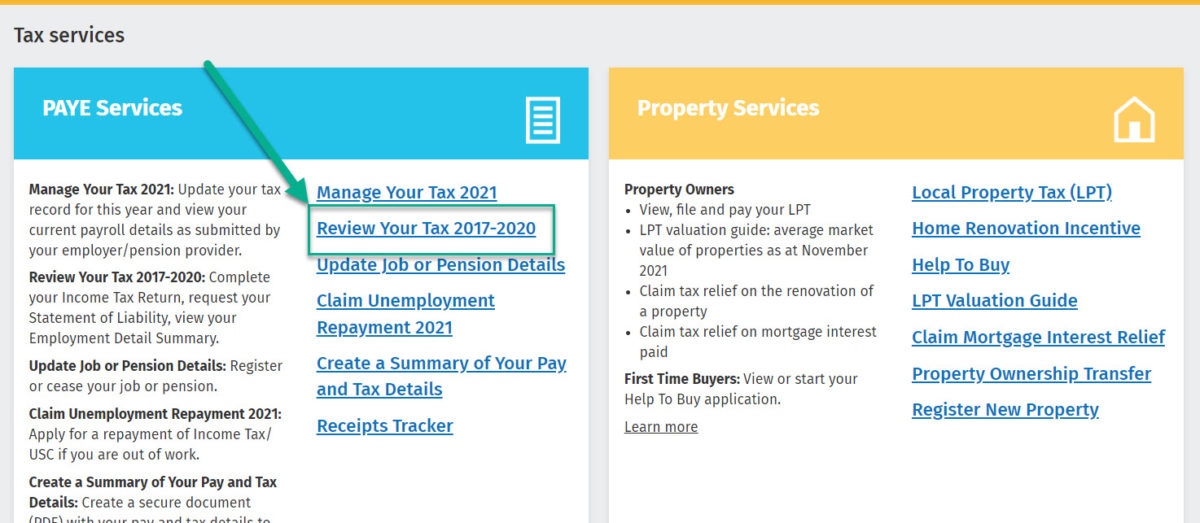

STEP 2: Under PAYE Services click Review your Tax 2016 – 2019

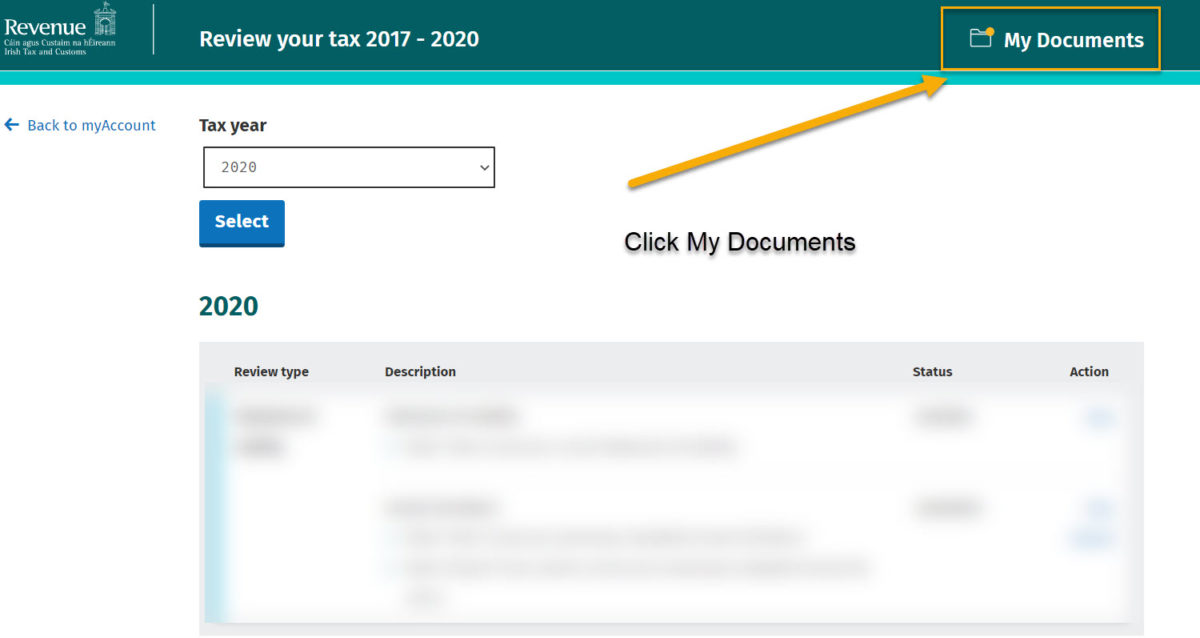

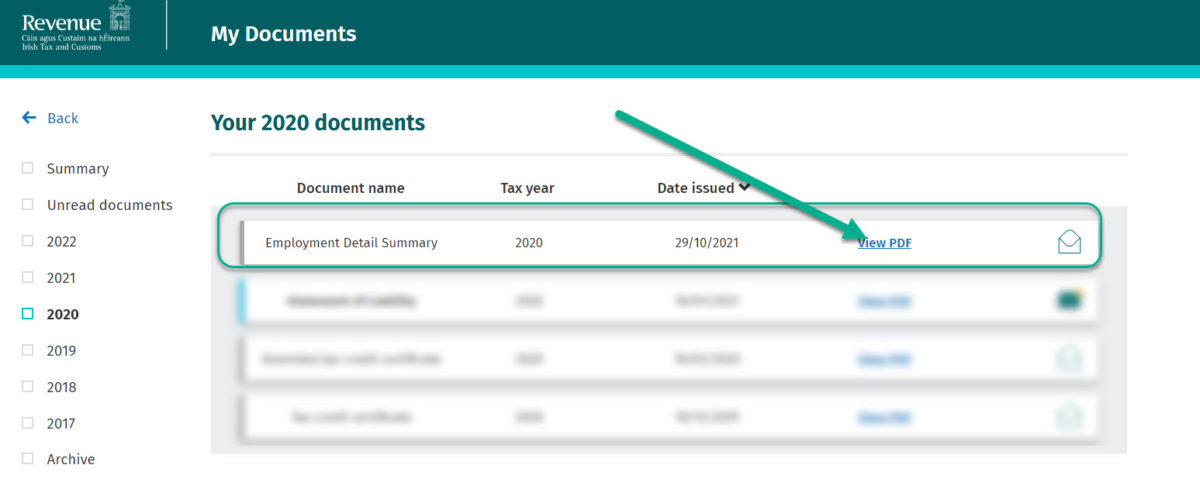

STEP 3: Click My Documents link

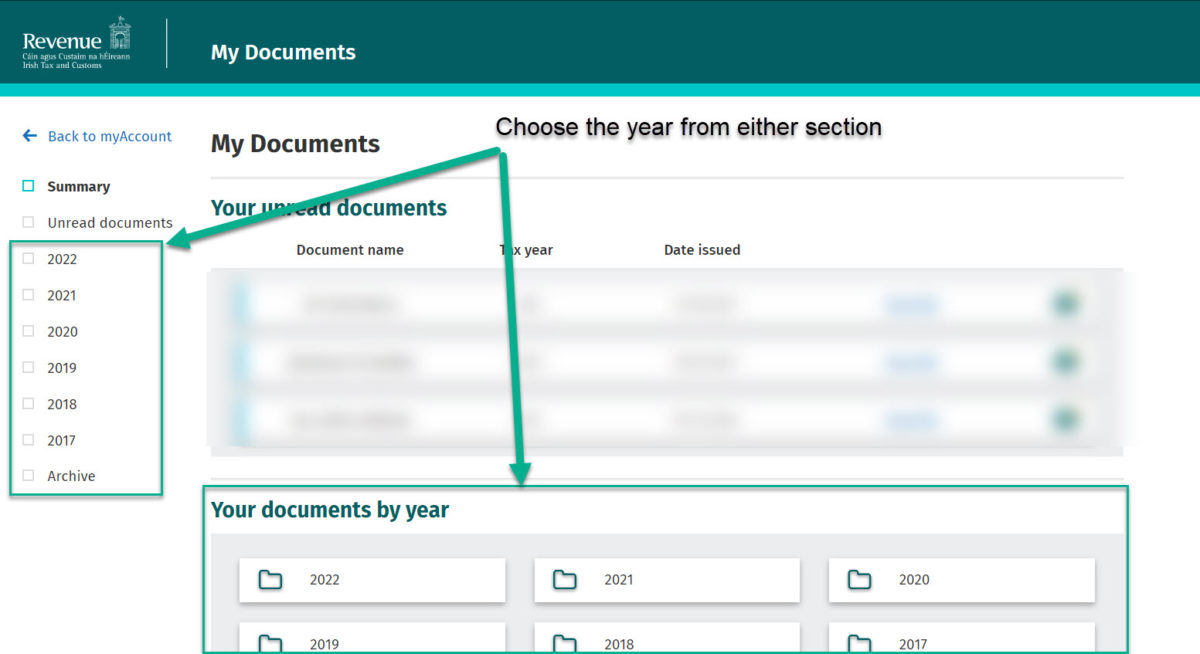

STEP 4: Access your documents by choosing the year you wish to view.

STEP 5: Once your documents page appears Click the View PDF link.

…..and the PDF will open in another tab/window in your browser where you can print or save it.

And that’s it….good luck!

↓ Ever wondered how payroll outsourcing works? ↓

For tips, tricks and payroll updates, SUBSCRIBE OR follow us on Twitter, LinkedIn, Facebook or Instagram.

A useful guide, thanks for taking the time to post the screenshots!

Hi.Can i do this for 2018 is well?Than k you

Hi Jozsef, only from 2019 (as that years was the start of PAYE Modernisation in Ireland)

You should have received a P60 for 2018.

Is 2020 p6o available yet

The Employment Detail Summary replaces the P60 from 2019 onwards Ann and can be accessed via myAccount. Follow the instructions above and you should be ok.

thank you so much, I’m trying for a while to find this

hi how ı can get my 2014 and 2015 P60 ?

Hi, you can get these from your employer who should have a copy. If your employer use Jefferson as a provider, we provide employer printable/email copies as backup so they issue to you. Hope this helps !

Thank you so much, this really helped me

Great guide, it really helped.

Hi, I started working for a company in Dubin as part-time from mid-December 2019 and started working as a full-time employee from August 2020. In this scenario, should I be getting P60 for 2019 since I worked for hardly 10 days in December of 2019? As of now, the P60 document for 2019 shows 0.00 for all the line items starting from “Gross salary” to “Employer PRSI paid”

Hi, you may have got a P60 because you may have had an Insurable Week in 2019. You may not have been paid in 2019 which would indicate the 0.00 values for 2019. If your first payment was in Jan 2020, the payment for the 10 days in 2019 will be within those figures as it is not when you worked that is relevant but rather when you were paid for it. If in any doubt, please call Revenue and quote your PPS number and they can explain it for you. I hope this helps!

Hi,

I am not able to view my employment summary page after following the steps . could you please tell me how to get it for the year 2020

Hi Aditi,

Slight changes in myAccount screens (which happens!) so we updated the post above now.

Hope this helps!

Regards,

The Team at Jefferson

I am trying to get my P.60 replacement EDS but after entering my details cannot access my account.

Hi I’m looking to get my 2014 P60 and contacted my old employer. They said they no longer have access to payroll files from that far back. Is there anything else I can do to get 2014 P60?

Hi Mary, not all employers hold P60s going back that far but (and depending on the software they use) you could request a statement of earnings for 2014 from them which will suffice as a P60 replacement.

P60 my employer doesn’t give us anymore .I cant give information I haven’t got

The Employment Detail Summary replaces the P60 from 2019 onwards Gerard and can be used as your statement of earnings for the tax year.

Hi, is there any reason why I can not see this on my revenue?

Hi,

I have followed the steps above but I am unable to view my Employment Detail Summary. I don’t have the option available to view it? Nothing in relation to the Employment detail summary comes up. Is there another way to generate this?

Hi, if I’m going to Review your Tax 2019 there is no link to Employment Detail Summary. I have only Statement of Liability and Income Tax Return.

Revenue changed it slightly so well spotted – have updated the post now so it is 5 steps instead of 7. Hope this helps!

This doesn’t work for anything that predates 2019. I’m looking at getting my 2017 and 2018 employment detail summary but it simply doens’t exist for some reason. They have been calculated yes, as I do my returns every years, so it’s not that they need to be submitted because they were.

Hi Martin,

The Employment Detail Summary only came in from 2019. Your employer should have issued you a P60 for 2017 & 2018.

You will need to contact them for a copy of those.

My former employer went bankrupt and closed down and I am looking for my employment financial documents/P60 etc for the period 2000 to 2007. Surely revenue should still have this on record if I write to them?

Hi Lucy – P60s are (were!) generated from payroll systems rather than Revenue so they won’t have P60 copies but they should have a record of your earnings and tax via the P35 return for those years. Depending on what you need these for, you can try two things:

1. Login into myAccount and choose “My Enquires” in the top right hand corner. Send an enquiry to Revenue requesting a statement of these details.

2. Ask your former employer if they archived off documents or backed up the payroll software before closing down. The statutory requirement to Revenue is to keep 6 years + current year so this may be a difficult ask for 2000 to 2007.

Is the Employment Detail Summary updated throughout the year or only updated once per year?

If it’s only once a year, when is it updated?

I will be starting work in Ireland and will need to show my Employment Detail Summary within the first 6 months (I need to sponsor my wife’s visa and need to show my “P60”).