Why do I have a “W” on my payslip as I my employer received a new RPN (Tax Cert) from Revenue?

Week 1/Month 1 Basis certificates have a status of “W” on your payslips and are mainly issued in the following circumstances:

- There is substantial reduction of tax credits which may cause hardship, e.g., this might happen when your partner or spouse returns to work mid tax year and you were availing of their credits.

- There is a lack of information about prior employments or earnings in the current tax year.

- The residence intentions of a person coming from abroad to take up employment here are not known.

- Tax credits/Standard Rate Bands are transferred, e.g., similar to 1) above.

- An employee does not wish his new employer to know the details of his/her previous pay and tax.

In addition to above Employers will also operate Week 1/Month 1 Basis to payments made in the following circumstances:

- Payments made to a ceased employee

- Payments made on Week 53

- Payments made to an employee who has been out sick for more than 6 weeks and the employer excluded his/her Disability Benefit in calculating pay and tax.

Effect of Week 1/Month 1 Basis

- Each week’s/month’s pay and tax is calculated independently without reference to the previous week/month.

- No refunds are made

- Week 1 Basis cases are subject to review after the end of the tax year.

Any undercharge arising is collected by either restriction of the tax credits of a subsequent year or by assessment.

Hardship

In addition to above employers may also operate Week 1/Month 1 Basis to where hardship arises, i.e., where an amendment on a cumulative basis results in the individual having little or no take-home pay.

In establishing whether hardship will arise the following factors should be considered:

- The amount of reduction in tax credits and rates of tax

- The length of time that has already elapsed in the tax year

- The estimated rate of pay

You can contact Revenue for more by logging in to myAccount or using the contact locator., they can explain exactly why you have a “W” status on your payslip

(Source:Revenue)

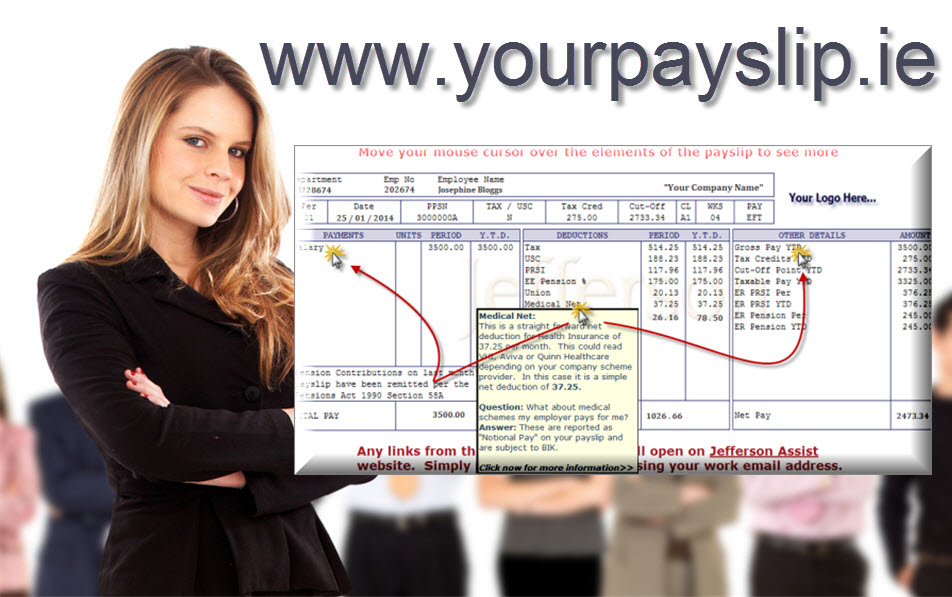

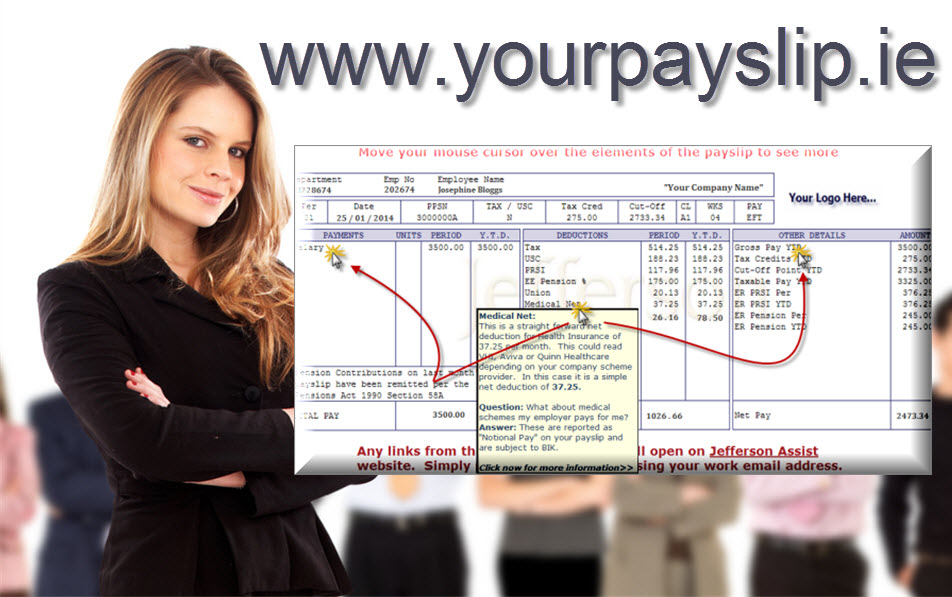

↓ Ever wondered how payroll outsourcing works? ↓

For regular tips, tricks and payroll updates, enter your email on our site, OR follow us on Twitter, Facebook, Instagram, or LinkedIn All the best, The Team at Jefferson

My tax is set at W shoudl I concerned about this or is this correct.

Thank you.

Thank you. Very helpful explanation!

Hi my tax was set to W last week. But why?

@ Michael – best to contact Revenue via myAccount or by using the contact locator on their site. They will explain why as every person’s circumstances vary.

What is the difference between USC code “C” and USC code “N”? I have searched high and low and cant find any information on what the various codes are associated to USC as well and what the various codes and descriptions are for CL/PRSI codes, e.g. “A1”.

Will appreciate any feedback!!

Hi Jeanne – C and N are the same. N is the old letter used and stands for “Normal” (or Cumulative).

C is now used for Cumulative instead. It applies to TAX (PAYE) and USC statuses. These should always match.

For PRSI Classes , this is a good resource:

https://www.citizensinformation.ie/en/social_welfare/irish_social_welfare_system/social_insurance_prsi/social_insurance_classes.html#

My tax is set at W is this correct or need to be N. My office asked me why I’m on W. I need to call Revenue to change on N.

Haw you look at this?