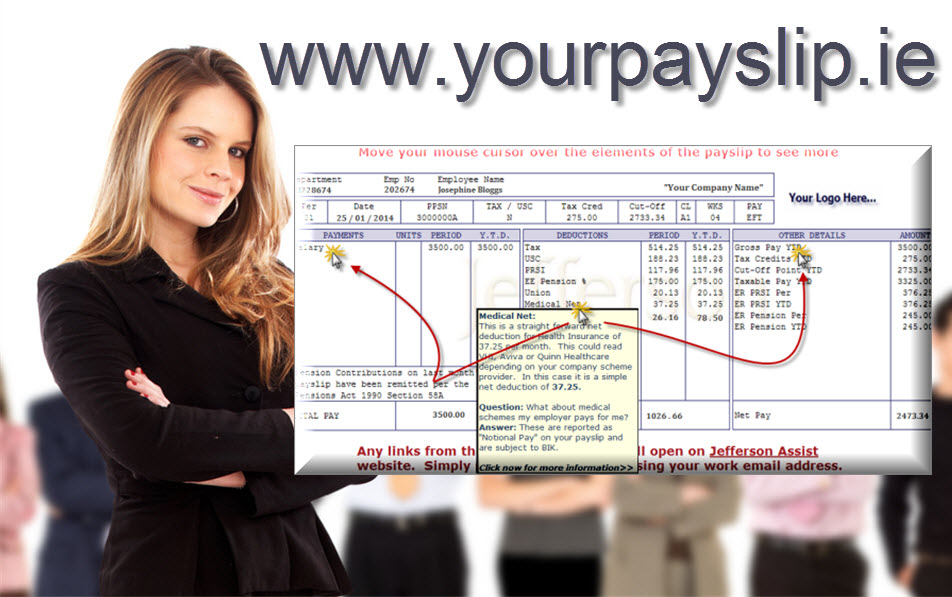

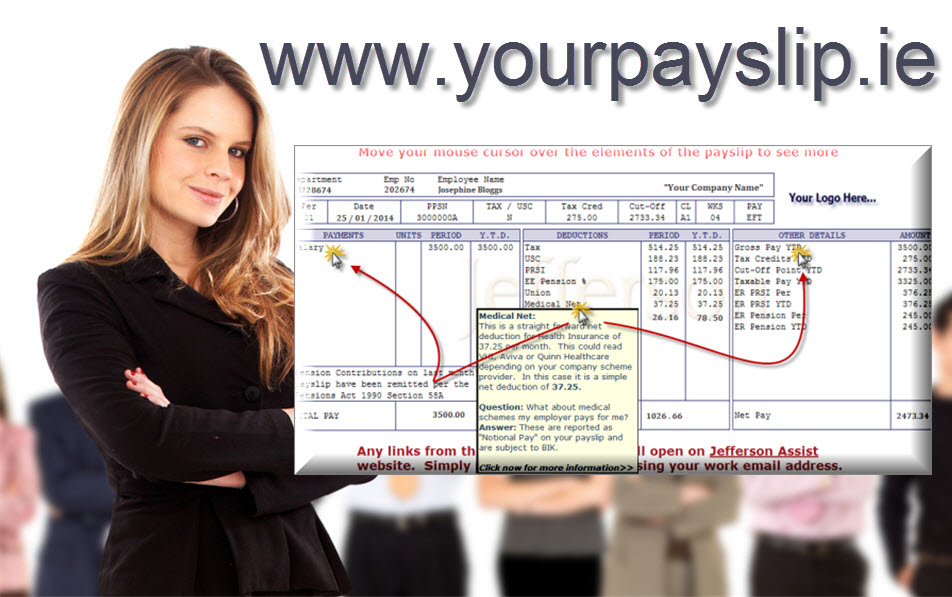

Values for company provided benefits that are subject to BIK (Benefit-In-Kind) are reported as “notional pay” (NP) on your payslip so that Tax, PRSI & USC can be calculated on them.

In other words, notional pay is the value of a non-cash benefit. It is not a payment you receive but it is included in your total taxable pay year to date figure.

Your Notional Pay YTD is the total for the current tax year that have been included for tax purposes.

Some examples of Notional Pay items include that:

- Company Cars

- Company Paid Private Health Insurance

- Company Paid Accommodation

- Preferential Loans

↓ Ever wondered how payroll outsourcing works? ↓

For regular tips, tricks and payroll updates, enter your email on our site, OR follow us on Twitter, Facebook, Instagram, or LinkedIn All the best, The Team at Jefferson